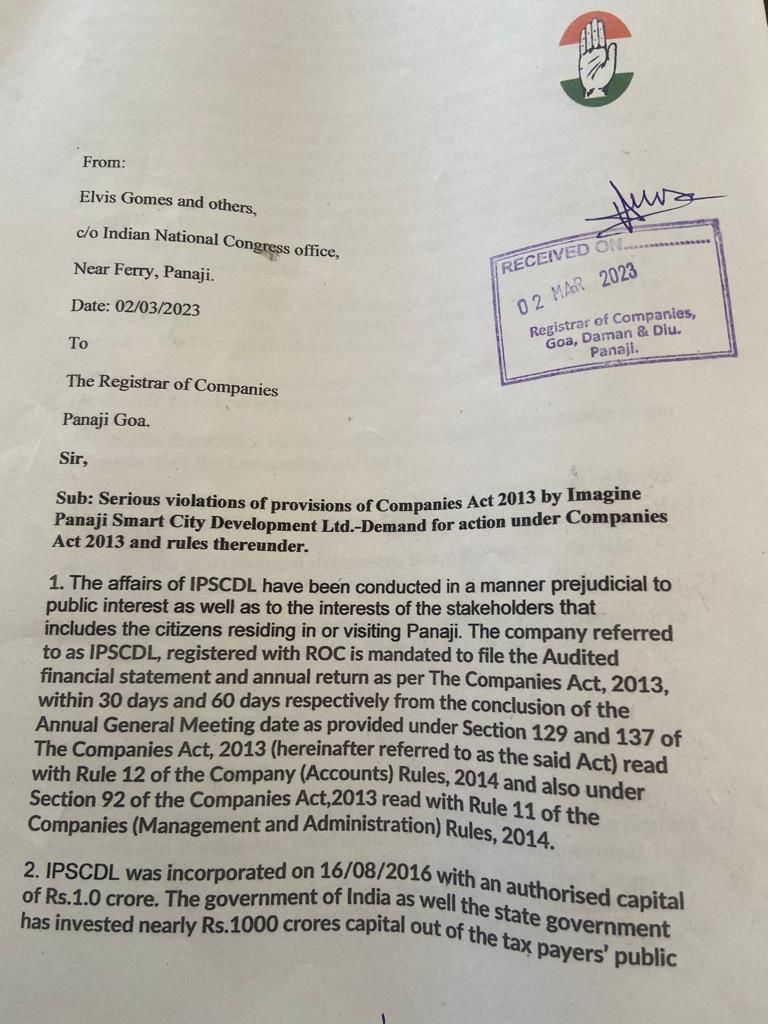

From:

c/o Indian National Congress office,

Near Ferry, Panaji.

Date: 02/03/2023

To

The Registrar of Companies

Panaji Goa.

Sir,

Sub: Serious violations of provisions of Companies Act 2013 by Imagine Panaji Smart City Development Ltd.-Demand for action under Companies Act 2013 and rules thereunder.

- The affairs of IPSCDL have been conducted in a manner prejudicial to public interest as well as to the interests of the stakeholders that includes the citizens residing or visiting Panaji. The company referred to as IPSCDL, registered with ROC is mandated to file the Audited financial statement and annual return as per The Companies Act, 2013, within 30 days and 60 days respectively from the conclusion of the Annual General Meeting date as provided under Section 129 and 137 of The Companies Act, 2013 (hereinafter referred to as the said Act) read with Rule 12 of the Company (Accounts) Rules, 2014 and also under Section 92 of the Companies Act,2013 read with Rule 11 of the Companies (Management and Administration) Rules, 2014.

- IPSCDL was incorporated on 16/08/2016 with an authorised capital of Rs.1.0 crore. The government of India as well the state government has invested nearly Rs.1000 crores capital out of the tax payers’ public funds which calls for greater scrutiny of the functioning of the entity. The financial statement for the period 16/08/2016 to 31/03/2017 was reportedly signed by the BoD on 14/11/2017. However, the same was adopted in the AGM held on 16/04/2021 in clear contravention of the provisions of the provisions of Section 92 of the Companies Act 2013 which requires that a company should hold its AGM within 09 months of the closure of the financial year. This default attracts penalties u/s 137 and u/s 97 of the said Act.

- Inspection of particulars of IPSCDL on MCA website reveals that the company has been in repeated default by not filing the financial statements for the years ending 31/03/2018, 31/03/2019, 31/03/2020, 31/03/2021, 31/03/2022. Add to that, the company has also been in repeated default by not holding AGM, not adopting financial statements, and not filing Annual Returns with the ROC. This should have by now resulted in strict action under the provisions of section 137 read with section 96 of the Companies Act which the ROC appears to have not initiated.

- Since the BoD has failed in the discharge of statutory duties, the ROC is expected to act under the provisions of Section 164 of the said Act to disqualify the Directors and deactivate their DIN.

- There is also no record of meetings of Board of Directors which are required to be held preceding AGM to:

- Authorize the auditor for the preparation of financial statements as per Schedule III of the Companies Act, 2013.

-Authorize the Director or Company Secretary for preparation of Board Report and Annual Return as per the Companies Act, 2013.

-Approve the draft financial statements, Board Report, and Annual Return by the directors of the company,

- The said Act prescribes an elaborate procedure for every company to attach important documents while filing the ROC such as:

Balance-Sheet:

Profit & Loss Account

Annual Return

Cost Audit Report - It need not be emphasised that safeguards are introduced to protect investors and stake holders and ensure that frauds are prevented. In the case of IPSCDL, provisions of the Companies Act 2013, the Company (Accounts) Rules, 2014 and the Companies (Management and Administration) Rules, 2014 have been flouted with impunity. The ROC has a duty cast upon it to take appropriate action against such companies that are defaulters. The ROC is duty bound to initiate proceedings invoking penal provisions as are prescribed under the said Act and Rules thereunder.

- In the present case, IPSCDL is found to be a habitual defaulter and therefore upholding the sanctity of the Companies Act 2013 and Rules made thereunder, ROC is called upon to disqualify the Directors in the first instance and all withdrawals of public money made unauthorisedly be held as illegal. The ROC is also required to investigate criminal breaches of Companies Act by IPSCDL and possible fraudulent conduct and protect the interest of the people who are suffering the effects of an ill planned, unguided venture called Smart City by IPSCDL.

9.The Annual Report of a Government company is also required to be placed before the Parliament or the State Legislature as provided under Section 394 of the said Act. IPSCDL has also failed to abide by these provisions thus leaving scope for mismanagement, misappropriation, and fraud in the rush of expenditure of around 1000 crores resorted to in violation of all guidelines mandated for Smart City Mission. - The CAG has also not brought out any reports of audit carried out in any of these years which is again questionable as precious public resources cannot be allowed to be squandered beyond the rule of law. A request for special audit of IPSCDL has been made to the CAG vide letter dated a copy of which is enclosed for your reference.

- A set of 50 questions have been raised before the IPSCDL vide letter date a copy of which is enclosed for your reference.

- Trust necessary action will be initiated most immediately as the with closure of the mission scheduled for June 2023 and many of the, key managerial personnel may no longer be available and an attempt may be made to bury the illegalities under the carpet.

Yours Sincerely,